The Board adopted the most restrictive definition of “independence” when appointing the current members of its Compensation and Nominating committees.

The Board believes that these steps represent a good faith effort to addressrespond to the commentsfeedback received as a result of its shareholder outreach and represent meaningful steps to align its corporate governance practices with the interests of its shareholders and current best practices. As is our standard practice, we will continue to engage with our shareholders and will take feedback we receive from them into account as we evolve our corporate governance practices according to the needs of our business.

Leadership Structure

The Chairman of the Board is elected by the members of the Board and typically presides at all meetings of the Board. Bruce F. Simberg currently serves as our Chairman, a position he has held since 1998 other than a brief hiatusthe period from March 2015 to January 2016. Richard W. Wilcox Jr., an independent member of the Board since 2003, served aswas named the Board’s Lead Independent Director during that hiatusMr. Simberg’s absence from the Chairman position, and continues to hold that position in recognition of his significant knowledge of the Company’s history, growth and operations.operations and his contributions, along with those of Mr. Simberg, to the oversight of the Company. The responsibilities of the Company’s Chairman of the Board are: (i) presiding at all meetings of the Board (with the Lead Independent Director presiding at meetings where the Chairman is not present), including presiding at executive sessions of the Board (without management present) at every regularly scheduled Board meeting, (ii) serving as a liaison between management and the independent directors, (iii) providing input regarding meeting agendas, time schedules and other information provided to the Board, and (iv) being available for direct communication and consultation with major shareholders, as appropriate, upon request.shareholders. Our Chairman also has the authority to call meetings of the independent directors. The Chief Executive Officer is currently the only member of management on the Board.

The Company believes that its Board as a whole should encompass a diverse range of talents, skills, perspectives, experiences, and experiences,tenure on the Board, enabling itthe Board to provide sound guidance with respect to the Company's operations and interests. The Company's policy is to have at least a majority of directors qualify as independent as defined by the listing and maintenance rules of The Nasdaq Stock Market (the “Nasdaq Rules”). The Nominating Committee identifies candidates for election to the Board of Directors; reviews their skills, characteristics and experience; and recommends nominees for director to the Board for approval. The Nominating Committee's Charter provides that the Board of Directors as a whole should be balanced and diverse, and consist of individuals with various and relevant career experience, relevant technical skills, industry knowledge and experience, financial expertise and local or community ties. Minimum individual requirements include strength of character, mature judgment, familiarity with the Company's business and industry, independence of thought and an ability to work collegially.colleially. The Board believes that the qualifications of the directors, as set forth in their biographies above provide them with the qualifications and skills to serve as a director of our Company.

Board Self-Assessment Process

The Board believes that ongoing self-assessment is important to strengthening its performance and fulfilling its role on behalf of the Company’s shareholders. To that end, the Board conducts an annual evaluation process that begins by asking each Board member to complete a comprehensive evaluation form that addresses the Board’s overall performance and a self-evaluation of the individual director’s performance. Overall Board performance is evaluated based on, among other things, the conduct of Board meetings, the composition of the Board, the quality of information provided to the Board, Board effectiveness, and access to management. Individual performance is evaluated to determine, among other things, whether the director continues to be able to devote the necessary time to Board and committee matters, whether the director’s skills are best utilized, and whether the director contributes to Board decision making. In addition, the Audit Committee conducts an annual evaluation of its performance, including a review of the effectiveness of its processes, the composition of the Committee, the Committee’s interactions with management and the Company’s auditors, and the Committee members’ understanding of the Company’s risks, controls and compliance. These evaluation forms are reviewed by the Chairman of the Board or the Audit Committee, and by the entire Board or Audit Committee, and are discussed in detail at a Board or Audit Committee meeting, as applicable.

Board Continuing Education

The Company encourages its directors to remain current in corporate governance, compliance and industry topics facing publicly traded insurance companies such as the Company. In that regard, the Company provides directors with the opportunity to attend seminars and conferences on director education, board leadership, current issues facing the insurance industry generally and the Florida and coastal insurance marketmarkets in particular, governance, risk management and other subjects of interest to Board members and relevant to the Company. Certain of our directors also obtain significant continuing education relevant to the Company in connection with their professional licenses and certifications in accounting, finance and law.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines, which have updated, consolidated and memorialized the corporate governance practices followed by the Board and the Company. Among other things, the guidelines address the following matters relating to the Board and its committees:

| · | Director qualifications generally and guidelines on the composition of the Board and its committees; |

| · | Director responsibilities and the standards for carrying out such responsibilities; |

| · | Board membership criteria; |

| · | Board committee requirements; |

| · | Director access to management and independent advisors; |

| · | Director orientation and continuing education requirements; and |

| · | CEO evaluation, management succession and CEOChief Executive Officer evaluation, management succession and Chief Executive Officer compensation. |

The Corporate Governance Guidelines are reviewed at least annually by the Board.

Risk Oversight

The Board’s role in connection with risk oversight is to oversee and monitor the management of risk practiced by the Company’s management in the performance of their duties. The Board does this in a number of ways, principally through the oversight responsibility of committees of the Board, but also as part of the strategic planning process. For example, our Audit Committee oversees management of risks related to accounting, auditing and financial reporting, maintaining effective internal controls over financial reporting, and information security and technology risks. Our Nominating Committee oversees risk associated with corporate governance and the Company’s code of conduct, including compliance with listing standards for independent directors and conflicts of interest. Our Compensation Committee oversees the risk related to our executive compensation plans and arrangements and is responsible for reviewing and recommending our non-employee director compensation plans and arrangements. Our Investment Committee oversees the risks related to managing our investment portfolio. The full Board receives reports on a regular basis regarding each committee’s oversight from the chairperson of each committee when reporting on their committee’s actions at regular Board meetings, as well as overseeing the development and implementation of strategic initiatives.

Meetings and Committees of the Board of Directors

During 2016,2018, the Board of Directors held 11ten regular meetings, sevenfive special meetings and took actions by written consent on foursix occasions. During 2016,2018, no director attended fewer than 75% of the Board and committee meetings held during this period. The Board of Directors encourages, but does not require, its directors to attend the Company’s annual meeting. All of our directors attended our 20162018 annual meeting.

The Board has determined that the following continuingall of its directors and director candidates are independent pursuant to the Nasdaq Rules applicable to the Company: Bruce F. Simberg, Richard W. Wilcox Jr., Jenifer G. Kimbrough, William G. Stewart and Thomas A. Rogers. With Carl Dorf’s retirement atCompany, with the Annual Meeting, fiveexception of the six continuing directors will be independent.Company’s Chief Executive Officer. The Board has also used the stricter definition of “independence” utilized by shareholder advisory services in determining the members of the Compensation and Nominating committees in 2017, with the result that Mr. Simberg, whose law firm has provided a limited amount of legal services to the Company, will not serve on either committee insince 2017. The matters handled by the firm have been completed or are in the process of completion and the Company does not at this time anticipate retaining his firm for future matters. Please see “Certain Relationships and Related Transactions—Related Transactions” below for more information.

The independent directors of the Board meet in executive sessions without management present. These sessions, which generally occur at every regularly scheduled Board meeting, are led by the Chairman. Executive sessions allow the independent directors to discuss, among other issues, management performance and compensation.

To facilitate the Board’s oversight functions and to take advantage of the knowledge and experience of its members, the Board has created several standing committees. These committees, the Audit, Investment, Nominating, Compensation and Business DevelopmentStrategy committees, allow regular risk oversight and monitoring, and deeper analysis of issues before the Board. The Audit, Compensation, Investment and Nominating committees are composed exclusively of independent directors. The membership of the standing committees is reviewed from time to time, and specific committee assignments are proposed and appointed by the Board. Each committee holds regularly scheduled meetings and confers between regularly scheduled meetings as needed.

Charters for the Audit, Compensation and Nominating committees, and the Corporate Governance Guidelines, are available upon the Company’s website at www.FedNat.com and are also available in print to any shareholder upon request from our Corporate Secretary.

In connection with the Cooperation Agreement (please see “BoardRefreshment and Engagement with Shareholders” above), the Company has agreed that Mr. Michelson and Mr. Patterson will each be added to the Audit, Compensation and Nominating Committees.

Standing Board Committees

Audit Committee. As of December 31, 2016,2018, the Audit Committee was composed of Jenifer G. Kimbrough, who served as the Chair, Richard W. Wilcox Jr. and Carl Dorf.Roberta N. Young. Each member was determined to be “independent” as defined under the Nasdaq Rules applicable to the Company and SEC rules for Audit Committee membership. Ms. Kimbrough and Mrs. Young, who is aare Certified Public Accountant, wasAccountants, were designated as a “financial expert”experts” as that term is defined in the applicable rules and regulations of the Exchange Act based on hertheir understanding of U.S. generally accepted accounting principles (“GAAP”) and financial statements; hertheir ability to assess the general application of GAAP in connection with the accounting for estimates, accruals and reserves; hertheir experience preparing, auditing, analyzing and evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company’s financial statements, or experience actively supervising one or more persons engaged in such activities; hertheir understanding of internal controls and procedures for financial reporting; and hertheir understanding of audit committee functions. The Audit Committee held four regular meetings in fiscal 20162018 and oneno special meeting.meetings. It is currently expected that the same Board members will constitute the Audit Committee for 2019.

Pursuant to its written charter, the duties and responsibilities of the Audit Committee include, but are not limited to, (a) the appointment of the independent certified public accountants and any termination of such engagement, (b) reviewing the plan and scope of independent audits, (c) reviewing significant accounting and reporting policies and operating controls, (d) having general responsibility for all related auditing and financial statement matters, and (e) reporting its recommendations and findings to the full Board of Directors. The Audit Committee pre-approves all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed by the independent accountants, subject to the de minimisexceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act that are approved by the Audit Committee prior to the completion of the audit.

To ensure prompt handling of unexpected matters, the Audit Committee delegates to the Chair the authority to amend or modify the list of approved permissible non-audit services and fees. The Chair will report action taken to the Audit Committee at the next committee meeting. The Chief Financial Officer is responsible for tracking all independent auditor fees against the budget for such services and reports at least annually to the Audit Committee.

With the retirement of Carl Dorf following the Annual Meeting, the Board will select another member with the requisite knowledge of financial statements to serve on the Audit Committee.

Compensation Committee. As of December 31, 2016,2018, the Company’s Compensation Committee was composed of Jenifer G. Kimbrough, Bruce F. Simberg, Thomas A. Rogers and Richard W. Wilcox Jr. Each member is independent as defined by the Nasdaq Rules. The Compensation Committee performs the duties and responsibilities pursuant to its charter, which includes reviewing and approving the compensation of the Company's executive officers. Mr. Wilcox serves as the Chairman. During fiscal 2016,2018, the Compensation Committee held three regular meetings and one regularspecial meeting and eight special meetings.took action by written consent on one occasion. For 2017,2019, the members of the Compensation Committee are Jenifer G. Kimbrough, Thomas A. Rogers and Richard W. Wilcox Jr.

For the 2016 fiscal year, the Compensation Committee engaged the independent executive compensation consulting firm of Meridian Compensation Partners, LLC (“Meridian”) to review the structure and competitiveness of the Company’s executive and director compensation for 2016. Meridian provides no other services to the Company other than those directly to the Compensation Committee relating to executive and director compensation. Meridian attends meetings of the Compensation Committee at the request of the committee, meets with the Compensation Committee in executive sessions without the presence of management, and communicates with the Chairman of the Compensation Committee with respect to emerging issues.

The Compensation Committee Chairmanhas worked with compensation and certain Company officials furnished Meridian with information concerninggovernance consultants in prior years to assist the compensation of its executives and copies of their employment contracts. After review, Meridian providedBoard in updating the Compensation CommitteeCompany’s corporate governance practices generally, assist with a detailed report concerning its currentreview and futureupdate of the Company’s executive compensation program alongpractices, and assist with observations of comparable companies.the Company’s shareholder engagement program. The Compensation Committee met with a representativealso regularly reviews internally compiled data about the compensation practices of Meridian to review and discuss their findings and recommendations. The Compensation Committee may useour competitors. For the services2018 fiscal year, the Company engaged the firm of Meridian or other comparable companies in the futureMacKenzie Partners to assist it in providing a fairthe Board with research related to executive compensation practices and competitive compensation plan for its executives.our peers, and assist with the Company’s shareholder engagement program. MacKenzie Partners also provided proxy solicitation services to the Company.

Nominating Committee. As of December 31, 2016,2018, the Company’s Nominating Committee was composed of Jenifer G. Kimbrough, Carl Dorf, Richard W. Wilcox Jr., Bruce F. Simberg, Thomas A. Rogers, and William G. Stewart.Stewart and Roberta N. Young. Richard Wilcox serves as the committee chairperson. Each member is independent as defined by the Nasdaq Rules. During fiscal 2016,2018, the Nominating Committee held two regular meetings. For 2017, thetook actions by written consent on one occasion. The same Board members ofwill constitute the Nominating Committee have been Jenifer G. Kimbrough, Carl Dorf, Richard W. Wilcox Jr., Thomas A. Rogers and William G. Stewart.for 2019.

With Carl Dorf’s retirement to occur following the Annual Meeting, theThe Nominating Committee has begun the process of identifyingcontinues to identify qualified candidates for director.director positions. In recommending proposed nominees to the full Board, the Nominating Committee is charged with building and maintaining a Board that has an ideal mix of talent and experience to achieve the Company’s business objectives. In particular, the Nominating Committee considers all aspects

of a candidate’s qualifications in the context of the needs of the Company at that point in time with a view to creating a Board with a diversity of experience and perspectives. Among the qualifications, qualities and skills of a candidate considered important by the Nominating Committee is a person with strength of character, mature judgment, familiarity with the Company’s business and industry, independence of thought and an ability to work collegially. The Nominating Committee considers diversity, together with these other factors, when evaluating candidates, but does not have a specific policy in place with respect to diversity.

The Nominating Committee will consider candidates for director who are recommended by its members, by other Board members and by management of the Company and who have the experience and skill set best suited to benefit the Company and its shareholders. The Nominating Committee will consider nominees recommended by our shareholders if the shareholder submits the nomination in compliance with the advance notice, information and other requirements described in our bylaws and applicable securities laws. The Nominating Committee evaluates director candidates recommended by shareholders in the same way that it evaluates candidates recommended by its members, other members of the Board, or other persons.

Shareholders who wish to recommend nominees to the Nominating Committee should submit their recommendation in writing to the Secretary of the Company at its executive offices pursuant to the requirements contained in Article III, Section 13 of the Company’s Bylaws. This section provides that the notice shall include: (a) as to each person who the shareholder proposed to nominate for election, (i) name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of capital stock of the Company which are beneficially owned by the person, (iv) the consent of each nominee to serve as a director of the Company if so elected and (v) any other information relating to the person that is required to be disclosed in solicitation for proxies for the election of directors pursuant to Rule 14A under the Exchange Act; and (b) as to the shareholder giving the notice, (i) the name and record address of the shareholder, and (ii) the class and number of shares of capital stock of the Company which are beneficially owned by the shareholder. The Company may require any proposed nominee to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as a director of the Company. To be timely, a shareholder’s notice shall be delivered to or mailed and received at the Company’s principal executive offices not less than 60 days nor more than 90 days prior to the meeting. If we give less than 70 days’ notice or prior public disclosure of the date of the meeting date, however, notice by the shareholder to be timely must be so received not later than the close of business on the tenth day following either the date we publicly announce the date of our annual meeting or the date of mailing of the notice of the meeting, whichever first occurs.

Investment Committee. As of December 31, 2016,2018, the Company’s Investment Committee was composed of Carl Dorf,William G. Stewart, Bruce F. Simberg and William G. Stewart.Roberta N. Young. The Investment Committee manages our investment portfolio pursuant to its adopted Investment Policy Statement. Mr. DorfStewart serves as the Chairman. During fiscal 2016,2018, the Investment Committee held fivefour regular and three special meetings. With Carl Dorf’s retirement to occur following the Annual Meeting, theThe same Board may select another member to serve onmembers will constitute the Investment Committee.Committee for 2019.

Business DevelopmentStrategy Committee.As of December 31, 2016,2018, the Company’s Business Strategy Committee (previously called the Business Development CommitteeCommittee) was composed of Thomas A. Rogers, Michael H. Braun and Bruce F. Simberg. The Business DevelopmentStrategy Committee provides advice, oversight and guidance both to management of the Company and to the Board on matters involving the Company’s development of programs and projects, and acquisitions of new technologies or products and other business opportunities of strategic importance to the Company. Mr. Rogers serves as the Chairman. During fiscal 2016,2018, the Business DevelopmentStrategy Committee held four regular meetings. The same Board members will constitute the Business Strategy Committee for 2019.

Code of Conduct

We have adopted a Code of Conduct for all employees, officers and directors of the Company. A copy of our Code of Conduct is available on our web site at www.FedNat.com.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires that our executive officers, directors, and persons who own more than 10% of a registered class of our equity securities to file reports of beneficial ownership and certain changes in beneficial ownership with the SEC and to furnish us with copies of those reports. To our knowledge, based solely on a review of the copies of such reports furnished to us or written representations that no other reports were required, we believe that during the year ended December 31, 2016, our officers, directors and greater than 10% shareholders timely filed2018, all reports required by Section 16(a). were timely filed except for one report that was filed late due to an administrative error.

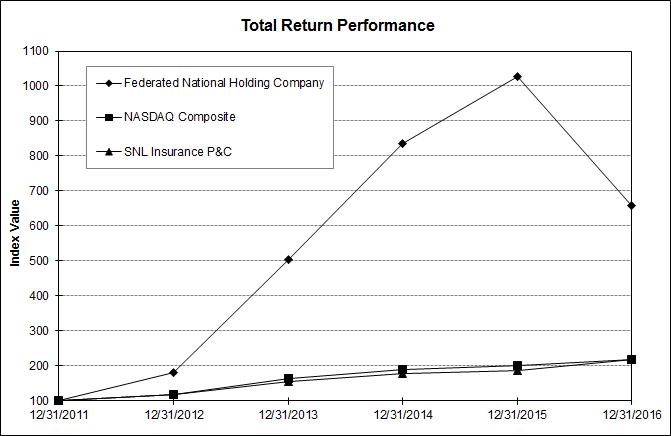

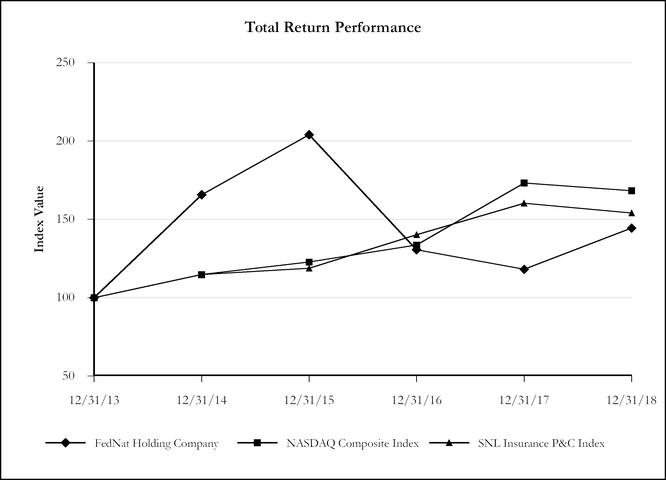

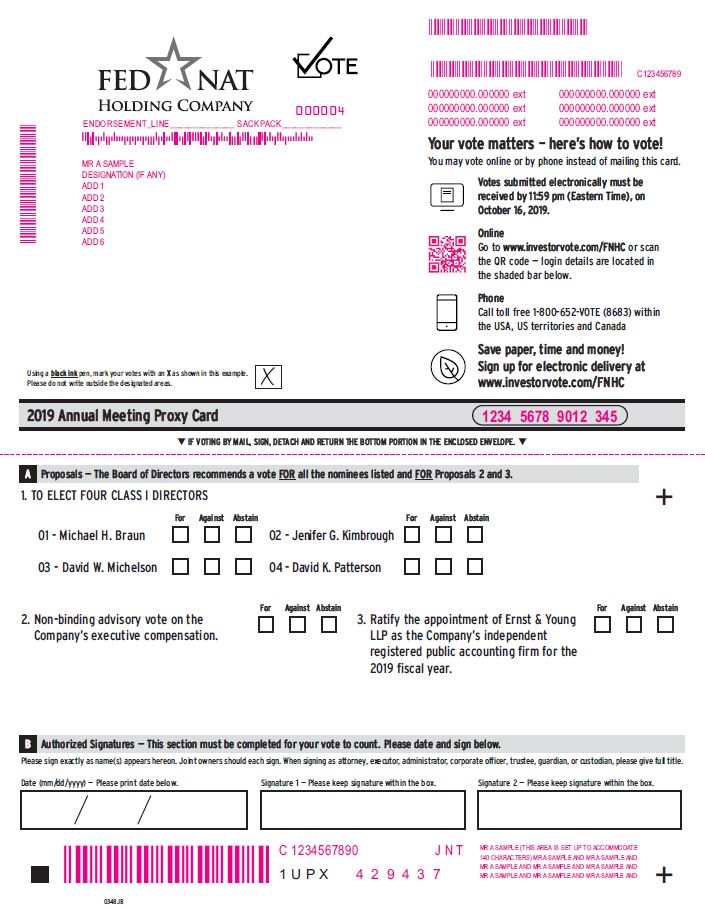

The chart below shows the Company’s cumulative total shareholder return during the five fiscal years ending December 31, 2016.2018. The graph also shows the cumulative total returns of the SNL Insurance P&C Index and the NASDAQ Composite Index. The comparison assumes $100 was invested on December 31, 20112013 in the Company’s common stock and in each of the indices shown, and assumes that all of the dividends were reinvested. Past performance is not necessarily an indicator of future results.

Our filings with the SEC may incorporate information by reference, including this proxy statement. Unless we specifically state otherwise, the information under this heading "Stock Performance Graph" shall not be deemed to be "soliciting materials" and shall not be deemed to be "filed" with the SEC or incorporated by reference into any of our filings under the Securities Act of 1933, as amended (the “Securities Act”), and Exchange Act.

Federated NationalFedNat Holding Company

| | | Period Ending | |

| Index | | 12/31/11 | | | 12/31/12 | | | 12/31/13 | | | 12/31/14 | | | 12/31/15 | | | 12/31/16 | |

| Federated National Holding Company | | | 100.00 | | | | 181.39 | | | | 503.83 | | | | 835.03 | | | | 1,027.79 | | | | 658.07 | |

| NASDAQ Composite | | | 100.00 | | | | 117.45 | | | | 164.57 | | | | 188.84 | | | | 201.98 | | | | 219.89 | |

| SNL Insurance P&C | | | 100.00 | | | | 118.04 | | | | 156.39 | | | | 179.61 | | | | 185.79 | | | | 219.27 | |

|

| | | | | | | | | | | | |

| | Period Ending |

| Index | 12/31/12 |

| 12/31/13 |

| 12/31/14 |

| 12/31/15 |

| 12/31/16 |

| 12/31/17 |

|

| FedNat Holding Company | 100.00 |

| 165.73 |

| 203.99 |

| 130.61 |

| 118.07 |

| 144.41 |

|

| NASDAQ Composite | 100.00 |

| 114.75 |

| 122.74 |

| 133.62 |

| 173.22 |

| 168.30 |

|

| SNL Insurance P&C | 100.00 |

| 114.85 |

| 118.80 |

| 140.21 |

| 160.30 |

| 154.12 |

|

Source : SNL Financial LC, Charlottesville, VAS&P Global Market Intelligence

© 20162019

www.snl.com

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis describes the components and objectives of the Company’s executive compensation program for fiscal 20162018 for our “Named Executive Officers,” describes the process through which the decisions regarding executive compensation have been made, and describes the results of this decision-making process. Our Named Executive Officers for fiscal 20162018 were our Chief Executive Officer and President our Interim Chief Financial Officer and our former Chief Financial Officer. The following Compensation Discussion and Analysis reflects the compensation paid to our Named Executive Officers for fiscal 20162018 and the Compensation Committee’s decisions with respect to the compensation for fiscal 20172019 for the Named Executive Officers.

Philosophy of the Company’s Executive Compensation Programs

The Compensation Committee of the Board is responsible for establishing, implementing and monitoring adherence to the Company’s compensation philosophy and oversees our compensation programs for our Named Executive Officers. With respect to executive compensation, the Compensation Committee’s primary goals are to attract and retain the most qualified, knowledgeable, dedicated and seasoned executives possible; provide challenging but attainable goals by which to measure performance; reward them for their contributions to the development of the Company’s business; and align the executives’ compensation and incentives with the Company’s performance and the interests of our shareholders. The Compensation Committee also endeavors, while compensating our Named Executive Officers for their performance, to structure the Company’s compensation programs so as to not encourage unnecessary or excessive risk-taking. The Compensation Committee believes that crafting incentives so as to not encourage unnecessary or excessive risk taking is especially important in the homeowners’ insurance industry in the Company’s home state of Florida.

The Compensation Committee is committed to ensuring our compensation programs are strongly aligned with the Company’s long-term business strategy. The Committee seeks to continuously and rigorously evaluate its compensation plans to reflect strong governance practices and shareholder feedback.

|

| | | |

| | What We Do | | What We Do Not Do |

✓ü

| Established long-term performance-based criteria for the equity awards to our Chief Executive Officer, which for 20172018 constituted 50%, and for 2019 will constitute, 50%40% of his total incentive award. | x | No change-in-control excise tax gross-ups. |

✓ü

| Implemented a clawback policy that allows for the recovery of previously paid incentive compensation in the event of a restatement of our financial statements. | x | No tax gross-ups on perquisites. |

✓ü

| EstablishedMaintain rigorous stock ownership and retention guidelines for our executive officers and directors. | x | No excessive perquisites. |

✓ü

| ConductedExecute a robust shareholder outreach program in response to our 2016 say-on-pay vote to solicit investor feedback on compensation plan design and disclosure.disclosure and which we will continue in connection with this Annual Meeting. | x | No hedging or pledging of the Company’s common stock. |

✓ü

| Amended our Chief Executive Officer’s employment agreement to requireRequire a “double trigger”"double trigger" for the payment of change-in-control payments to him,our Named Executive Officers, meaning that payments will not be triggered without a qualifying termination following a change in control, and to provide that hisany such change in control payment would be based on the average of the preceding three years’years' actual bonuses earned. | x | No option repricing or repurchases of underwater options without shareholder approval. |

The Company’s 20162018 Performance

The Company’s financial results for 20162018 reflect the impact of multiple severe weather events in Florida and the other challengesstates in which we operate, including Hurricanes Michael and Florence. Our 2018 earnings also reflected continued, but diminishing, headwinds from the Company’s operating environment, such as the continuing frequency of the assignment of benefits by insureds to third parties. Nevertheless,non-core operations, automobile and commercial general liability, from which the Company achievedis continuing to exit. The Company took action to improve its underwriting profitability during 2017 and 2018 that significantly improved results within our core operations, homeowners insurance, and believes it is well positioned for continued earnings growth and increased shareholder value in 2019 and beyond. The significant accomplishments during 2016 that2018 include:

Total revenue in our homeowners line of business increased 13.4% to $364.8 million, driving consolidated total revenue growth of 1.1%, despite the substantial reduction in revenue from the non-core lines of business we are exiting.

Net income attributable to the Company’s shareholders grew to $14.9 million, up 86.9% over the prior year.

Book value per share, excluding non-controlling interest, grew to 6% to $17.13 from $16.16 in 2017, overcoming the substantial adverse impact of Hurricane Michael.

We maintained the Company’s dividend at $0.08 per quarter, returning almost $4.2 million to shareholders based on dividends paid during the year.

Through rigorous focus on exposure management and underwriting, the Company believes will result in increased shareholder value, such as:

reduced the cost of its catastrophe reinsurance program by approximately $30 million for the 2018-2019 treaty year.

| · | 22.6% increase in gross written premiums to $605.5 million, reflecting market share growth in our homeowners’ and personal automobile lines of business; |

The Company continued its expansion outside of Florida. Collectively, gross written premium in Alabama, Louisiana, South Carolina and Texas increased by 48.1% in 2018 to over $81 million.

| · | 9.8% increase in Florida homeowners’ policies to approximately 279,000; |

We reduced our total staffing by over 100 positions during 2018, as we continue to maximize operational initiatives, representing annualized savings of approximately $6 million.

| · | 26.6% increase in total revenue to $316.4 million; |

Lastly, the Company completed a thorough due diligence and negotiation process culminating in our recent announcement of the pending acquisition of the insurance operations of 1347 Property Insurance Holdings, Inc. This pending transaction will further diversify the Company’s premium base, adds organic non-Florida agent distribution, and increases our scale, and is expected to be meaningfully accretive to 2019 earnings.

| · | Continued development of our partnerships to expand the policies we write, including our agreement with Allstate, and our new agreement with GEICO; |

| · | Increases in the Company’s dividend from $0.05 per share beginning December 1, 2015, to $0.06 per share beginning June 1, 2016 and to $0.08 per share beginning December 1, 2016; and |

| · | Approval of an average statewide FNIC Florida homeowners’ rate increase of 5.6% in effect since August 1, 2016, with another rate increase of 9.9% to be effective August 1, 2017. |

Coupled with those accomplishments, however, were the significant increase in losses from multiple weather events, most particularly Hurricane Matthew, which impacted Florida and South Carolina in October 2016, and the inflated costs of handling homeowners’ claims in Florida, primarily as a result of the growth of assignment of benefits by insureds. The Company anticipates that its approved and pending rate increases should gradually offset the increased costs associated with assignment of benefits claims. In the fourth quarter of 2016, the Company recorded for Hurricane Matthew $47.0 million of gross claims, which represented a decrease from the initial estimate of $77.5 million, and $21.4 million of claims, net of reinsurance. The Company also increased its total loss reserves by $30.6 million during the quarter, which increased the Company’s total loss reserves at December 31, 2016 to $158.1 million. The foregoing resulted in a net loss of $0.2 million or $(0.01) per undiluted share for the year ended December 31, 2016.

Results of Our Evaluations

The following table summarizes the Compensation Committee’s 20162018 compensation decisions for our Named Executive Officers, consistent with how the Compensation Committee views total compensation. The information regarding performance-based compensation is presented both in terms of “Target” compensation and the actual achievement thereof. See the footnotes to the table for further information. The Compensation Committee reached these compensation decisions based on its evaluation of performance relative to the incentive criteria established at the beginning of 20162018 as described below.below, and taking into account actual progress made toward important Company initiatives. For comparative purposes, the table also presents 20152017 and 20142016 compensation decisions for our Named Executive Officers. While the table below summarizes how the Compensation Committee views compensation, it is not a substitute for the tables and disclosures required by the SEC’s rules, which begin on page 29.32. Further detail on how individual pay decisions were made and descriptions of the elements of compensation can be found following this table.

|

| | | | | | | | | | | | | | | | | | | | | | |

Named Executive Officer | Year | Base Salary Rate | Annual Incentive and Other Cash Awards | Long-Term Incentive and Other Share-Based Awards | Total Compensation |

| Target | Actual | Target | Actual-to-Date | Target | Actual-to-Date |

Michael H. Braun,

Chief Executive Officer and President (1) | 2018 | $ | 1,000,000 |

| $ | 875,000 |

| $ | 534,167 |

| $ | 875,000 |

| $ | 0 |

| $ | 2,750,000 |

| $ | 1,534,167 |

|

| 2017 | $ | 1,000,000 |

| $ | 875,000 |

| $ | 698,333 |

| $ | 875,000 |

| $ | 0 |

| $ | 2,750,000 |

| $ | 1,698,333 |

|

| 2016 | $ | 1,000,000 |

| $ | 0 |

| $ | 0 |

| $ | 0 |

| $ | 0 |

| $ | 1,000,000 |

| $ | 1,000,000 |

|

Ronald A. Jordan,

Chief Financial Officer (2) | 2018 | $ | 290,000 |

| $ | 108,750 |

| $ | 100,000 |

| $ | 108,750 |

| $ | 100,000 |

| $ | 507,500 |

| $ | 490,000 |

|

| 2017 | $ | 275,000 |

| $ | 0 |

| $ | 100,000 |

| $ | 0 |

| $ | 151,500 |

| $ | 275,000 |

| $ | 526,500 |

|

| 2016 | $ | 0 |

| $ | 0 |

| $ | 0 |

| $ | 0 |

| $ | 0 |

| $ | 0 |

| $ | 0 |

|

| Named Executive Officer | Year | Base Salary Rate | Annual Incentive Awards | Long-Term Incentive Awards | Total Compensation |

Michael H. Braun, CEO and President (1) | 2016 | $ | 1,000,000 | $ | 0 | $ | 0 | $ | 1,000,000 |

| 2015 | $ | 600,000 | $ | 1,200,000 | $ | 1,200,000 | $ | 3,000,000 |

| 2014 | $ | 475,000 | $ | 950,000 | $ | 1,293,000 | $ | 2,693,300 |

Peter J. Prygelski, III, CFO and Treasurer (2) | 2016 | $ | 325,000 | $ | 0 | $ | 0 | $ | 325,000 |

| 2015 | $ | 325,000 | $ | 487,500 | $ | 243,750 | $ | 1,056,250 |

| 2014 | $ | 300,000 | $ | 450,000 | $ | 0 | $ | 750,000 |

| Erick A. Fernandez, Interim CFO and Treasurer (3) | 2016 | $ | 212,000 | $ | 30,000 | $ | 63,228 | $ | 305,228 |

| 2015 | $ | 0 | $ | 0 | $ | 0 | $ | 0 |

| 2014 | $ | 0 | $ | 0 | $ | 0 | $ | 0 |

| |

| (1) | The 2018 annual incentive award was paid in 2019 for short-term performance goals met in 2018 and included a discretionary component. The 2018 long-term incentive award of 53,713 shares of restricted stock (at Target payout level) was granted in 2018 for performance-based goals to be met over a three-year period from 2018 to 2020. Such goals were not met in 2018, resulting in the forfeiture of 11,936 shares (or $194,000 based on the grant date share price), thus far, from this grant. The 2017 annual incentive award was paid in 2018 for 2017 short-term performance goals met in 2017. The 2017 long-term incentive award of 47,971 shares of restricted stock (at Target payout level) was granted in 2017 for performance-based goals to be met over a three-year period from 2017 to 2019. Such goals were not met in 2017 and 2018, resulting in the forfeiture of 21,320 shares (or $389,000 based on the grant date share price), thus far, from this grant. |

| |

| (2) | The 2018 annual incentive award was paid in 2019 for short-term performance goals met in 2018, and included a discretionary component. The 2018 long-term incentive award includes:(1) 6,675 shares of restricted stock was granted in 2018 for performance-based goals to be met over a three-year period from 2018 to 2020. Such goals were not met in 2018, resulting in the forfeiture of 1,482 shares (or $24,000 based on the grant date share price), thus far, from this grant; and (2) 5,546 shares of restricted stock (or $100,000) granted in 2019 that time-vests over a five-year period. Mr. Jordan joined the Company in April 2017 and was not a participant in the 2017 incentive compensation plan. The 2017 cash award was paid in 2018 for Mr. Jordan’s efforts during 2017. Mr. Jordan received a grant of 10,000 shares of restricted stock (or $151,500 based on the grant date share price) and $100,000 for relocation expenses as part of the terms of his employment when he joined the Company. The relocation allowance is not included in this table, as the Compensation Committee deems to be an expense reimbursement rather than compensation. |

(1) Of the amount noted in long-term incentive awards for 2016, $600,000 was paid in cash and $600,000 was granted as restricted stock.

(2) Mr. Prygelski separated from the Company in June 2016.

(3) Mr. Fernandez became the Company’s Interim Chief Financial Officer and Treasurer in June 2016. The annual incentive award for Mr. Fernandez was paid pursuant to a bonus agreement entered into prior to his appointment as the Interim Chief Financial Officer pursuant to which he was entitled to receive a minimum bonus of $40,000 for 2016, $30,000 of which was paid in 2016. The long-term incentive award consists of restricted stock vesting over three years that was granted to him also prior to his appointment as Interim Chief Financial Officer.

Shareholder Outreach and “Say-on-Pay”

At our advisory shareholder vote on executive compensation in 2016,2018, our say-on-pay proposal received the affirmative vote of 49.07%80.7% of the shares voted on the proposal. In response toThe 2018 and 2017 say-on-pay votes were a significant improvement over the results of the 2016 say-on-pay vote, and reflecting the Compensation Committee has soughtCommittee’s meaningful efforts to seek and receivedreceive feedback and guidance from shareholders and others regarding the Company’s executive compensation practices, with a viewplans, and to incorporate this feedback into our practices. These efforts are designed to better understand and address investor concerns, while continuing to evolve our compensation practices in a way that both meets the Board’s compensation goals and benefits our shareholders.

Outreach Process. The Compensation Committee discussed the results A proactive approach to shareholder communication continues to be part of the 2016 say-on-pay vote at its meetings following the 2016 annual shareholders meeting, and directed that the Company engage in a comprehensiveour ongoing process. Our outreach program that went beyond its ordinary-course investor relations program. The outreach process for 2018 was led by the Chairman of our Compensation Committee, Richard W. Wilcox Jr., who participated in all discussions with investors. Other participants in our outreach process included our Corporate Secretary and, as necessary or appropriate,

outside counsel, independent compensation consulting firm, and MacKenzie Partners, our proxy solicitation firm. The Compensation Committee was given regular updates on investor feedback during these discussions.

Extent of Outreach. During the course of our outreach during 2018, we contacted all of the Company’s top 30 shareholders, representing approximately 62% of our outstanding common stock.stock, which followed similarly extensive outreach efforts during 2017. We received responses from and engaged in dialogue with seven of these shareholders, each of which owned at least 0.3% of our outstanding shares. We will continue this outreach process during the months preceding our 20172019 annual meeting. We may also heldhold discussions with the major proxy advisory firms to learn more about their perspectives, policies and evaluation of our executive compensation program.

The Compensation Committee has carefully considered the shareholder feedback and guidance it received in 2018 and has undertaken a comprehensive review of, and made severalcontinued to refine the positive changes to our executive compensation program.program previously implemented.

|

| | | |

| What We Heard | | How We Responded |

| § | §The metrics used to determine awards under the short and long-term incentive plans should be different from one another and closely tied to Company performance, and Compensation Committee should minimize discretionary payouts.

| § | §The Compensation Committee eliminated discretionary payouts from our Chief Executive Officer’s incentive compensation. Instead, forBeginning in 2017, the Compensation Committee has approved a new formula-based short and long-term incentive plan structure for evaluating our Chief Executive Officer’s performance, beginning in 2017, with 50% of his incentive award based on annual financial goals that reflect the Company’s financial and operating performance on a year-to-year basis, and 50% based on long-term financial goals that reflect the growth realized by the Company’s shareholders over a more extended horizon. This incentive structure continued in 2018, including further refinement of the annual and long-term metrics, as described below.

|

§

| The use of increase in gross revenues as a performance metric may encourage growth at the expense of overall profitability.

| §

| For the 2019 incentive compensation plan, we have eliminated the performance-based metric related to increasing in gross revenues. Such action is consistent with our stated focus on increasing our profitability and growing our net income.

|

| § | Our historical reliance on time-based vesting of equity awards should be reduced, with the emphasis instead on performance-based vesting of equity. | § | Beginning in 2017, a portion of our Chief Executive Officer’s awards under the incentive plan were granted 100% in the form of performance-based equity. In 2018, this approach was applied to the Chief Financial Officer's incentive compensation as well. |

| § | Awards made under the long-term incentive plan should be granted predominantly in the form of equity, rather than cash. | §Beginning in 2017, a portion of our Chief Executive Officer’s awards granted under the long-term incentive plan will be granted 100% in the form of performance-based equity.

|

| § | §The Company should clearly disclose the performance metrics, goals and weighting that were considered when determining our Named Executive Officers’ incentive compensation payouts.

| § | §We have substantially revamped and restructured our Compensation Discussion and Analysis to provide a more detailed and transparent presentation of the alignment between pay and performance. Although the Company does not provide earnings guidance, and accordingly has not disclosed the specific measurement levels for thecertain performance metrics, we have expanded our disclosures to provide certain measurement levels and otherwise describe how the measurement levels for 2017 were determined.

|

§ | The Company should consider amending its executive employment agreement(s) from a “single-trigger” for the payment of change of control bonus to a “double-trigger” for payment. | § | §We entered into amendments to the employment agreement withamended our Chief Executive OfficerOfficer’s employment agreement to provide for a “double-trigger”“double- trigger” for payment of his change of control bonus and to modify the calculation of that bonus to be based on the average of the Chief Executive Officer’s actual bonuses received for the three years prior to the change of control. This same provision was incorporated into the employment agreement recently executed with our Chief Financial Officer.

|

Evaluation Process

The Compensation Committee conducts an annual review of the total compensation of our executive officers, executive compensation, as well as the mix of elements used to compensate our Named Executive Officers. This review is based in part on an analysis of feedback from shareholders and current best practices in executive compensation and in part on a survey of executive compensation paid by various comparable publicly traded property and casualty insurance companies as reported in each company’s proxy statement. In evaluating executive compensation programs of peer companies, the Compensation Committee considers both a group of direct peers and a broader group of peers.

For 2016,2018, our direct peer group encompassed publicly traded companies that compete with us in the Florida homeowners’ insurance market, a market with unique performance characteristics and competitive factors:

- Heritage Insurance Holdings, Inc. (NYSE: HRTG)

- HCI Group, Inc. (NYSE: HCI)

- United Insurance Holdings Corp. (NASDAQ: UIHC)

- Universal Insurance Holdings, Inc. (NYSE: UVE).

| |

| – | Heritage Insurance Holdings, Inc. (NYSE: HRTG) |

| |

| – | HCI Group, Inc. (NYSE: HCI) |

| |

| – | United Insurance Holdings Corp. (NASDAQ: UIHC) |

| |

| – | Universal Insurance Holdings, Inc. (NYSE: UVE). |

This direct peer group remains the same for 2017.2019.

In addition to the four Florida-based insurance companies listed above, the Company included the following companies in its peer group for comparison purposes for 2016:

2018:

| |

| – | Safety Insurance Group Inc. (NASDAQ: SAFT) |

| |

| – | Donegal Group Inc. (NASDAQ: DGICA) |

| |

| – | Greenlight Capital Re Ltd. (NASDAQ: GLRE) |

| |

| – | Third Point Reinsurance Ltd. (NYSE: TPRE) |

| |

| – | Hallmark Financial Services (NASDAQ: HALL) |

| |

| – | First Acceptance Corp. (NYSE: FAC) |

| |

| – | Atlas Financial Holdings Inc. (NASDAQ: AFH) |

| |

| – | EMC Insurance Group Inc. (NASDAQ: EMCI) |

| |

| – | Baldwin & Lyons (NASDAQ: BWINB) |

| |

| – | Atlantic American Corp. (NASDAQ: AAME) |

- Safety Insurance Group Inc. (NASDAQ: SAFT)

- Donegal Group Inc. (NASDAQ: DGICA)

- Greenlight Capital Re Ltd. (NASDAQ: GLRE)

- Third Point Reinsurance Ltd. (NYSE: TPRE)

- Hallmark Financial Services (NASDAQ: HALL)

- First Acceptance Corp. (NYSE: FAC)

- Atlas Financial Holdings Inc. (NASDAQ: AFH)

- RLI Corp. (NYSE: RLI)

- EMC Insurance Group Inc. (NASDAQ: EMCI)

- Baldwin & Lyons (NASDAQ: BWINB)

- Atlantic American Corp. (NASDAQ: AAME)

These additional peers provide the Compensation Committee with a broader perspective of compensation practices among relevant insurance companies. The Committee assessed the competitiveness of the Company’s compensation program in comparison to the entire peer group, as well as the subset of the Company’s direct peers listed above who are the Company’s primary publicly traded competitors in the Florida homeowners’ insurance market.

For the 2016 fiscal year, the Compensation Committee engaged Meridian Compensation Partners, an independent executive compensation consulting firm, to review the structure and competitiveness of the Company’s executive and director compensation for 2016. Meridian provided no other services to the Company other than those directly to the Compensation Committee relating to executive and director compensation. Meridian attended meetings of the Compensation Committee at the request of the committee, met with the Compensation Committee in executive sessions without the presence of management, and communicated with the Chairman of the Compensation Committee with respect to emerging issues.

We also consider the industry knowledge and experience of our Committee members to be an important component of our compensation review process. Our Committee members each have substantial management experience in running businesses in the insurance, financial services and legal services industries, many of which have substantial management teams. As a result, their personal experience extends to developing and implementing management compensation and incentive programs, enabling our Committee members to use that experience when reviewing the Company’s executive compensation programs and working with MeridianMacKenzie Partners to make appropriate updates.

Meridian was provided with information about our Named Executive Officers’ historical compensation and the Company’s financial results, and was provided copies of their employment agreements. Meridian then delivered to the Compensation Committee a detailed report comparing the Company’s current executive compensation program to those comparable companies, together with recommendations for future updates. The Compensation Committee, on multiple occasions, met with or spoke with a representative of Meridian to review and discuss Meridian’s findings and recommendations. The Compensation Committee may use the services of Meridian or other consultants in the future to assist it in providing a fair and competitive compensation plan for its executives.

Elements of Compensation

The Compensation Committee has been committed to updating the Company’s executive compensation programs to reflect the Company’s growth and the evolution of best practices, and to reflect the feedback received as a result of our outreach to our largest shareholders. In that regard, the Compensation Committee approved in 2016 and 2017 a significant revamp of the Company’s compensation practices, in particular the incentive compensation of the Company’s Chief Executive Officer and President. These updated compensation practices have been carried forward into 2018 and 2019. The Company’s executive compensation programs for its Named Executive Officers consist of elements described below.

Base Salary.The Compensation Committee annually reviews the base salaries of the Named Executive Officers, and considers a number of factors, such as each Named Executive Officer’s level of responsibility, performance during the prior fiscal year (with respect to specific areas of responsibility and on an overall basis), past and present contributions to and achievement of Company goals, historical compensation levels of the Named Executive Officer, and the Company’s financial condition and results of operations.

Because of the unique performance characteristics and competitive factors in the Florida homeowners’ insurance industry, the Compensation Committee believes comparing the Company’s executive compensation to that of its direct peer group of Florida-based insurers, Heritage Insurance Holdings, Inc. (NYSE: HRTG), HCI Group, Inc. (NYSE: HCI), United Insurance Holdings Corp. (NASDAQ: UIHC) and Universal Insurance Holdings, Inc. (NYSE: UVE), provides the most meaningful insights into executive compensation. The unique factors that strongly influence the financial results of the Florida homeowners’ insurers include, among other things: the significance and complexities of exposure management, the potential occurrence of one or more severe hurricanes that can materially affect financial performance and has periodically driven national competitors from the market, the existence and large presence with the Florida market of a state-controlled insurer-of-last-resort in Citizens Property Insurance Corporation (“Citizens”) and the extent to which Citizens is seeking or reducing policies at any time and the market impact of fluctuations in its risk appetite, the significant percentage of properties in high-risk coastal areas, and the litigiousness of the Florida market. Accordingly, the Compensation Committee’s analyses for 2016 and 2017 focusedfocus significantly on our Chief Executive Officer’s base salary as compared to the annual base salaries of the Chief Executive Officers of our Florida-based direct peer group, as described in the table below:

| Company | | 2015 Annual CEO Salary(A) | | 2016 Annual CEO Salary(A) | | 2017 Annual CEO Salary(B) |

| Universal Insurance Holdings, Inc. | | $2,278,015 | | $2,306,456 | | $2,217,500 |

| Heritage Insurance Holdings, Inc. | | $750,000 | | $2,000,000 | | $2,100,000 |

| United Insurance Holdings Corp. | | $800,000 | | $966,667 | | $1,000,000 |

| Federated National Holding Company | | $617,308 | | $993,846 | | $1,000,000 |

| HCI Group, Inc. | | $500,481 | | $934,479 | | $950,000 |

| Median (excluding FNHC) | | $775,000 | | $1,483,334 | | $1,550,000 |

|

| | | | | | | | |

| Company | | 2017 Annual CEO

Salary (A) | | 2018 Annual CEO

Salary (A) |

| Universal Insurance Holdings, Inc. | | $ | 2,217,500 |

| | $ | 2,217,500 |

|

| Heritage Insurance Holdings, Inc. | | $ | 2,100,000 |

| | $ | 2,205,000 |

|

| United Insurance Holdings Corp. | | $ | 1,000,000 |

| | $ | 1,000,000 |

|

| FedNat Holding Company | | $ | 1,000,000 |

| | $ | 1,000,000 |

|

| HCI Group, Inc. | | $ | 950,000 |

| | $ | 950,000 |

|

| Median (excluding FNHC) | | $ | 1,550,000 |

| | $ | 1,602,500 |

|

| |

| (A) | As reported in each company's summary compensation table.company’s proxy statement. |

| (B) | As reported in each company's narrative proxy statement disclosures. |

The data from the table above enabled the Compensation Committee to measure our Chief Executive Officer’s base salary against the base salary levels for the chief executive officers of our Florida-based direct peer group. That review indicated that Mr. Braun’s base salary for 2015 was below the median for the Company’s direct peer group. The Compensation Committee also reviewed the compensation analysis report prepared by Meridian and, based on that report and the comparison to the Company’s direct peer group, the Compensation Committee approved an increase in Mr. Braun’s 2016 base salary to $1,000,000 to bring his base salary closer to the median. For 2017,2018, based on the Company’s results for 20162017 and a comparison of Mr. Braun’s salary to that of the direct peer group, Mr. Braun’s base salary remained the same. A similar reviewThe Compensation Committee also determined that Mr. Braun’s salary would remain unchanged for 2019.

Based on an analysis of market rates for 2018, our Chief Financial Officer’s base salary indicated that it was approximately at the median of our direct peer group, and therefore was not changed for 2016. Following the resignation of our Chief Financial Officer and the appointment of Mr. Fernandez as the Interim Chief Financial Officer in June 2016, Mr. Fernandez’sOfficer's base salary was set at $290,000. Based on Mr. Jordan's contributions to the Company since his arrival in 2017, and his increased level of experience, the Compensation Committee increased Mr. Jordan's salary for 2019 to $212,000. His base salary remained the same for 2017.

Incentive Compensation.Consistent with the Company’s pay-for-performance philosophy of compensating our Named Executive Officers for the Company’s achievements for the prior year and their roles in those achievements, and reflecting the feedback received from our outreach to our largest shareholders, in 2017 the Compensation Committee completely revamped the incentive compensation of our Chief Executive Officer. As a resultpart of this revamp, the Compensation Committee required for the annual bonus that the Company’s net income achieve a specified minimum threshold, in addition to the performance criteria described below. Mr. Braun’s incentive compensation will be entirely performance-basedfor 2018 was based on the pre-determined performance metrics described below. Reflecting the Company’s significant progress in important Company initiatives, however, Mr. Braun also received a discretionary bonus for 2018. The revamped pay-for-performance compensation structure remains in place for our Chief Executive Officer and anyChief Financial Officer for 2019, with a discretionary components have been eliminated.component that allows the Compensation Committee to consider achievement in other Company initiatives when awarding up to 10% of the annual award.

Annual Incentive Plan.For 2017,2018, 50% of Mr. Braun’s performance-based incentive compensation will beconsisted of an annual bonus payable in cash based in equal parts on increasing gross revenues,return on equity (“ROE”), controlling expenses, targeted EBITDA, and targeted EBITDA.the discretionary component. The Compensation Committee believesdetermined that these annual financial and operating metrics selected for the annual incentive plan appropriately reflectreflected the important measurements of the Company’s results of operations on a year-to-yearyear- to-year basis, and provideprovided incentives to grow the Company’s business in a cost-effective way.

The Compensation Committee determined the specific measurement levels for 2018 for the chosen performance metrics (for both the annual and long-term components) by extrapolating each metric’s target level from the Company’s recent actual performance results with a factor for growth of the Company. The Committee also considered the Company’s projected and longer-

term historic performance, as well as that of the direct peer group of Florida-based homeowners insurers and of the property and casualty insurance industry generally, when determining the target levels for each metric. The target levels of the metrics are intended to incentivize our Chief Executive Officer to direct the Company’s continued growth in a reasonable and efficient manner, while the maximum levels are intended to reward extraordinary accomplishments. The threshold levels reflect that, while the Company’s results can be severely impacted by events completely beyond the Company’s control, the Company’s ability to manage its exposure, effectively structure its reinsurance program and take other steps to improve expense control can mitigate the impact of those events.

For 2018, the Company’s performance as compared to the metrics used in our Chief Executive Officer’s annual bonus plan was as follows:

ROE was 8.3%, which was below the minimum;

Expense control was 40.3%, which substantially achieved the target level of 40.0%; and

EBITDA was $25.7 million, which was below the minimum.

As a result, for 2018, Mr. Braun’s bonus under the annual component of the plan was $284,167. The Compensation Committee elected to also award a discretionary incentive of $250,000, based on the substantial progress made during 2018 towards important Company initiatives. Specifically, the Committee considered the following achievements:

Rigorous exposure management that drove a $30 million reduction in the cost of the Company’s excess-of-loss catastrophe reinsurance spend for the treaty year ending June 30, 2019.

Growth in net income to $14.9 million, up 86.9% over 2017, driven by $22.2 million of earnings from our core homeowners business, a 689% increase over the prior year.

Streamlining of corporate operations and corresponding reductions in overhead, representing annualized savings of approximately $6 million.

The Compensation Committee believes these achievements are contributing to future earnings momentum. As a result, Mr. Braun’s total cash bonus for 2018 totaled $534,167.

Long-Term Incentive Plan.

2018 Plan.The remaining 50% of Mr. Braun’s 20172018 incentive compensation will beconsisted of a long-term incentive bonus payable in equity, based in equal parts on return on equity (“ROE”), increasedincreasing gross revenues, increasing book value per share and relative total shareholder return over three years (“Relative TSR”). The ROEincrease in revenue and increase in book value per share metrics will beare measured over successive one-year performance periods (but wouldthe goals are not be resetmodified from period to period), and the equity granted will vestvests 1/3 annually beginning one year after the grant date.

The metrics selected by the Compensation Committee for the 2018 long-term incentive plan are appropriate measures of the Company’s success over a longer time horizon, with particular emphasis on the measurements that are meaningful to the Company’s shareholders and relevant to the Company’s long-term business strategy and also contemplate the unique aspects of the Company’s business, in particular the material impact of hurricanes and other severe weather events that are inherently difficult to predict during any one year. The Compensation Committee believes that the annual measurement of the ROEincrease in revenue and increase in book value per share metrics provides an appropriate means of measuring long-term performance in an industry where external events that(i.e. hurricanes), pricing cycles, and claims trends (such as assignment of benefits) can have a material impact on the Company’s appetite for growth and its financial and operational results (i.e., hurricanes) occur during annual intervals.results.

The Compensation Committee combined the ROEincrease in revenue and increase in book value per share metrics with a Relative TSR metric that will beis measured over a three-year performance period, with the equity cliff vesting at the end of the three-year performance period based on the Company’s performance relative to its direct peer group of Florida-based homeowners’ insurers. For the Relative TSR metric, the Compensation Committee determined that the most appropriate comparison of the Company’s performance would be to this direct peer group of Florida-based homeowners’ insurers because of the unique competitive aspects of the Florida homeowners’ insurance market and because external factors such as hurricanes would likely impact all of the members of the direct peer group in a more consistent way. The Compensation Committee believes as well that the Company’s performance measures are appropriate when compared to the Company’s broader peer group.

2018 Achievement-Year 1 of 2018 Plan. The Company’s performance for 2018 as compared to the metrics used in our Chief Executive Officer’s long-term incentive plan was as follows:

Increase in gross revenues was 1.1%, which was below the minimum;

Increase in book value per share was 6.0%, which was below the minimum; and

The Relative TSR metric will not be determined for two more years.

As a result, Mr. Braun forfeited 11,936 performance-based shares (or $194,000 based on the grant date share price) that had been granted for 2018 under the long-term plan.

2018 Achievement-Year 2 of 2017 Plan. 2018 represented year two of the long-term portion of Mr. Braun’s 2017 incentive compensation. The Company’s performance as compared to the metrics used was as follows:

ROE was 8.3%, which was below the minimum;

Increase in book value per share was 6.0%, which was below the minimum; and

The Relative TSR metric will not be determined for one more year; however, cumulative performance through two years of the three-year measurement period is below the Threshold level of achievement.

As a result, Mr. Braun forfeited 10,660 performance-based shares (related to the ROE and increase in book value metrics) that had been granted for 2017 under the 2017 long-term plan.

2018 Achievement-2018 and 2017 Plans Combined. For the 2018 and 2017 long-term plans on a combined basis, total long-term compensation forfeited by the CEO based on the Company’s 2018 performance was approximately $388,000, based on the related grant date share prices.

Changes for 2019 Plan. As detailed under “Shareholder Outreach and Say on Pay” above, the Company has proactively sought shareholder input on its compensation practices. Based in part on feedback received from shareholders during 2018, the Compensation Committee determinedapproved several changes to the specific measurement levelsincentive compensation plan for 2019, which the chosenCompany believes retains the goals of relating executive compensation to Company growth and shareholder returns. These changes include:

The removal of increase in gross revenues as an incentive compensation metric, to avoid any incentive that might encourage unprofitable growth;

Total shareholder return was removed as a metric, as the Compensation Committee concluded it often does not accurately reflect the effectiveness of management’s actions over the performance metrics by extrapolating each metric’s target level fromperiod, due to the Company’s recent actual performance results with a factor for growthimpacts of macroeconomics, investor sentiment and other external factors;

ROE was moved to the long-term component of the Company. The Committee also consideredplan; and

Adjustments to the Company’s projectedrelative weighting of the annual and longer-term historic performance,long-term components of the plan, as well as thatthe underlying metrics contained therein.

Adding an option for the Compensation Committee to consider achievement of other important Company initiatives when determining up to 10% of the direct peer groupannual award.

The resulting components of Florida-based homeowners’ insurersthe incentive compensation plan for 2019 are as follows:

|

| | | | | | | | | | | | |

| 2019 Annual Incentive Plan: | | | | CEO Payout Factors |

| | | | | | | | | |

| Performance Metrics | | Weight | | Threshold | | Target | | Maximum |

| EBITDA | | 0.250 |

| | 1.00 |

| | 1.75 |

| | 2.50 |

|

| Expense Control | | 0.250 |

| | 1.00 |

| | 1.75 |

| | 2.50 |

|

| Discretionary Component | | 0.100 |

| | 1.00 |

| | 1.75 |

| | 2.50 |

|

|

| | | | | | | | | | | | |

| 2019 Long-Term Incentive Plan: | | | | CEO Payout Factors |

| | | | | | | | | |

| Performance Metrics | | Weight | | Threshold | | Target | | Maximum |

| ROE | | 0.200 |

| | 1.00 |

| | 1.75 |

| | 2.50 |

|

| Increase in Book Value per Share | | 0.200 |

| | 1.00 |

| | 1.75 |

| | 2.50 |

|

Note: The potential payout for each metric is calculated as base salary x Payout Factor x Weight.

The Threshold, Target and Maximum measurement levels were determined by the Compensation Committee with reference to the historical performance of the property and casualty insurance industry generally, when determiningadjusted to reflect the unique characteristics of the Florida property insurance market, and the Company specifically. Each level was developed such that the threshold level was reasonably achievable with good Company performance, the target level was achievable with superior Company performance, and the maximum level was achievable with exemplary Company performance. For 2019, the Compensation Committee determined that the threshold, target and maximum measurement levels for each metric. The targetthe Expense Control metric would be 45.0%, 40.0% and 35.0%. For the ROE metric, the corresponding measurement levels would be 10.0%, 12.0% and 14.0%. For the Increase in Book Value Per Share metric, the corresponding measurement levels would be 8.0%, 10.0% and 12.0%. These measurement levels were selected based on the Compensation Committee’s (and its advisors) perceptions of the metricslong-term expectations and are intended to incentivize our Chief Executive Officer to directnot indicative of earnings expectations for 2019 or any future period. It should be specifically noted that the Company’s continued growth in a reasonable and efficient manner, while the maximum levels are intended to reward extraordinary accomplishments. The threshold levels reflect that, while the Company’s results can be severely impacted by events completely beyond the Company’s control, the Company’s ability to manage its exposure, effectively structure its reinsurance program and take other steps to improve expense control can mitigate the impact of those events. The Company does not provide earnings guidance, and accordingly hasnor does it intend that the measurement levels provided above be interpreted as financial projections or indicative of the Company’s expectations as to its financial results for any current or future periods. Accordingly, the Company is not disclosedproviding the specific measurement pointslevels for the performance metrics. After performance forEBITDA metric at this time so as to avoid any interpretation of forward earnings guidance. Consistent with the 2017 fiscal year has been determined,Company’s prior practices, the Company intends towill disclose its results with respect to all of these performance metrics in its 20182020 proxy statement.

For our Chief Executive Officer, the resulting total potential payouts are $1.0 million, $1.75 million and $2.5 million at Threshold, Target and Maximum, respectively, with 60% attributable to the annual incentive and 40% attributable to the long-term incentive.

The Compensation Committee also consideredmaintained the EBITDA and expense control metrics in the annual component of the plan and supplemented it with a discretionary factor, with the annual component comprising 60% of the total incentive plan. ROE was moved to the long-term component with increase in book value per share, with the long-term component comprising 40% of the total incentive plan. With these changes, the Compensation Committee believes the 2019 incentive plan appropriately balances our Chief Executive Officer’s focus on both the short-term and long-term success of the Company.

The Compensation Committee determined that Mr. Braun will receive no increase in base salary for 20172019 when determining the minimum, target and maximum percentages of base salary for his 20172019 incentive compensation plan. In addition, the Compensation Committee believes that our Chief Executive Officer’s prospective maximum payout under his annual and long-term incentive compensation plan for 2017 as compared to the most recent incentive compensation reported by the Company’s Florida-based direct peer group demonstrates that Mr. Braun’s maximum potential payout2019 is well within the range of the actual awards made by the Company’s direct peer group. The Compensation Committee believes that the Company’s performance measures, as amended, are appropriate when compared to the Company’s broader peer group as well.

The total payout for both the annual and long-term incentive bonuses on a combined basis will be based on Mr. Braun’s base salary of $1,000,000 for 2017,2019, at the threshold, target and maximum payout factors indicated in the table below. No payouts will be made under the annual incentive plan unless the Company’s 20172019 net income is above a minimum threshold pre-determined by the Compensation Committee.

Annual Incentive Plan: | | | | Incentive Plan Payout Factors |

| | | | | | | | |

Performance Metrics | | Weight | | Threshold | | Target | | Maximum |

Increase in Gross Revenues | | 0.167 | | 1.00 (a) | | 1.75 (b) | | 2.50 (c) |

Expense Control | | 0.167 | | 1.00 (a) | | 1.75 (b) | | 2.50 (c) |

EBITDA | | 0.167 | | 1.00 (a) | | 1.75 (b) | | 2.50 (c) |

| | | | | | | | |

Long-Term Incentive Plan: | | | | Incentive Plan Payout Factors |

| | | | | | | | |

Performance Metrics | | Weight | | Threshold | | Target | | Maximum |

Return on Equity | | 0.167 | | 1.00 (a) | | 1.75 (b) | | 2.50 (c) |

Increase in Book Value | | 0.167 | | 1.00 (a) | | 1.75 (b) | | 2.50 (c) |

Relative TSR (3-Year) | | 0.167 | | 1.00 (a) | | 1.75 (b) | | 2.50 (c) |

| | | | | | | | |

Grand Total | | 1.000 | | $1.00M | | $1.75M | | $2.50M |

| (a) | = Potential payout for this metric at threshold equals $1.00 million x 1.00 x 0.167 (1/6 weight) |

| (b) | = Potential payout for this metric at target equals $1.00 million x 1.75 x 0.167 (1/6 weight) |

| (c) | = Potential payout for this metric at maximum equals $1.00 million x 2.50 x 0.167 (1/6 weight) |

The incentive compensation plan structure approved

Compensation of our Chief Financial Officer. For 2018, our Chief Financial Officer, Ronald A. Jordan, received an annual base salary of $290,000. He was also entitled to receive for 2017 is2018 an annual bonus, payable in stock and cash, with a significant departure fromtarget of 75% of his base salary and a maximum range of 112.5% of his base salary subject to the incentive compensation plan structure approved bysame performance criteria detailed above for the Chief Executive Officer. As described above, the Company exceeded the Threshold performance level for only the expense control metric, resulting in a calculated payment of $35,163. In light of Mr. Jordan’s contributions during 2018, including the continued strengthening of the Company’s reporting and analytical capabilities and internal controls, success in raising $45 million in debt to facilitate our first quarter 2018 buyout of the Monarch joint ventures partners, and achievement of expense reductions, the Compensation Committee increased Mr. Jordan’s 2018 bonus to $100,000.

As described above, the Company did not achieve the Threshold level of either of the annually measured metrics used in our long-term bonus plan during 2018. As a result, Mr. Jordan forfeited 1,482 performance-based shares (or $24,000 based on the grant date share price) that had been granted for 2016. 2018 under the long-term plan.

For 2016,2019, Mr. Braun was entitled to receiveJordan’s base salary is $325,000. His incentive bonus for 2019 will be based on the same short-term and long-term metrics as for our Chief Executive Officer with the same relative weightings, and will be payable in cash for the short-term bonus and in stock for the long-term bonus. The Payout Factors for both the annual and long-term awards as follows:

Performance Metrics | Weight | 2016 Results |

| Pre-tax income | 45% | $2.7 million |

| ROE | 45% | (5.38)% |

| Executive-specific goals | 10% | As determined by the Compensation Committee |

The annual and long-term awards for 2016 were toincentive bonuses on a combined basis will be based on a percentageTarget level of 100% of Mr. Jordan’s base salary of $325,000, Threshold level payout of 50% of base salary and paid 50% in cash and 50% inthe Maximum payout will be 150% of base salary, on a combined basis. No payouts will be made under the annual incentive plan unless the Company’s common stock. Of2018 net income is above a minimum threshold pre-determined by the equity portion, 75% would timeCompensation Committee. In addition, in light of the fact that Mr. Jordan received no shares at year end 2017, nor were any shares vested for 2018 under the 2018 Long-Term Incentive, as a retention tool, the Compensation Committee granted Mr. Jordan $100,000 of restricted stock (5,546 shares, based on the grant date fair value of $18.03) that will vest over five years and 25% would be granted with performance vesting criteria that will be evaluated over three years. The executive-specific goals for Mr. Braun included increasing the Company’s market share in Florida, expanding the Company’s marketing relationships, and expanding the Company’s product lines. The Compensation Committee determined that, although the Company had achieved significant accomplishments during 2016, as described above under “The Company’s 2016 Performance,” the Company’s results did not meet the goals established and therefore Mr. Braun would not be awarded any bonus for 2016.